ATO has introduced 19 activity statement form types in PLS. These are designed to support the reporting requirements for various obligations.

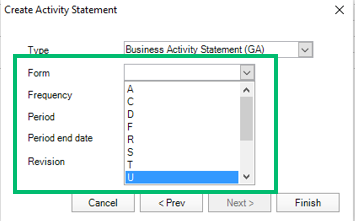

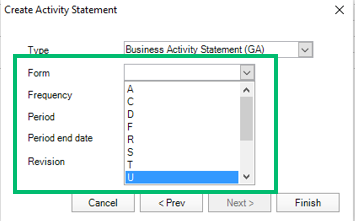

In a PLS activity statement, form type is a new mandatory field. This field must be completed when creating an activity statement manually and must match the ATO records.

You have 3 options to choose the form type. Ideally, use option 1 or 2 where the form type is pre-filled from the ATO data.

The easiest way to use our Creating an activity statement in the obligations homepage data to pre-fill the activity statement. This automatically pre-fills form type, taking the guesswork out of knowing which form type to choose.

You can perform a single request to add the activity statement manually. This is used for adding one client at a time, instead of multiple clients. This automatically pre-fills form type. Perform a single request to add activity statement obligations for 2014 and earlier.

Creating an activity statement is the same as you would do in ELS. The only difference is that you'll have to fill in the mandatory form type field. The form type you've selected must match ATO records.

If you use this option and you're not sure which form type to choose, refer to the table below o r call the ATO on 13 72 86 (fast key code 1 4 1).

You may find the form type in your last notice of assessment.

If you accidentally chose the incorrect form type, you'll need to delete and re-create the activity statement.

We've created this table to help you understand the differences in form type between ELS and PLS. Use it as a guide to choose the correct form type.

Click the PLS form type to see a sample form type on the ATO website.

Monthly Business activity statement

GST, PAYGI, PAYGW, FBTI, WET, LCT, Deferred COIN

Monthly Business activity statement

GST, PAYGI, PAYGW, FBTI, WET, LCT, Fuel tax credit

Quarterly Business activity statement

GST, PAYGI, PAYGW, Deferred COIN

Quarterly Business activity statement

GST, PAYGI, PAYGW, FBTI, WET, LCT, Deferred COIN

Quarterly Business activity statement

Quarterly Business activity statement

Quarterly Business activity statement

GST, PAYGI, PAYGW, Fuel tax credit (FTC)

Quarterly Business activity statement

GST, PAYGI, PAYGW, FBTI, WET, LCT, Fuel tax credit (FTC)

Quarterly Business activity statement

GST, Fuel tax credit (FTC)

Quarterly Business activity statement

GST, PAYGW, Fuel tax credit (FTC)

Quarterly PAYG instalment notice

Quarterly PAYG instalment notice (amount only)

Quarterly GST instalment notice

GST instalment (amount only)

Quarterly GST and PAYG instalment notice

GST and PAYG instalment amount

Instalment activity statement

PAYGI, Deferred COIN

Instalment activity statement

Instalment activity statement

PAYGI, PAYGW, FBTI, Deferred COIN

Annual instalment activity statement

PAYGI (instalment amount)

Annual GST return

Annual GST return, WET, LCT

Annual GST return

Annual GST return, WET, LCT, Fuel tax credit (FTC)